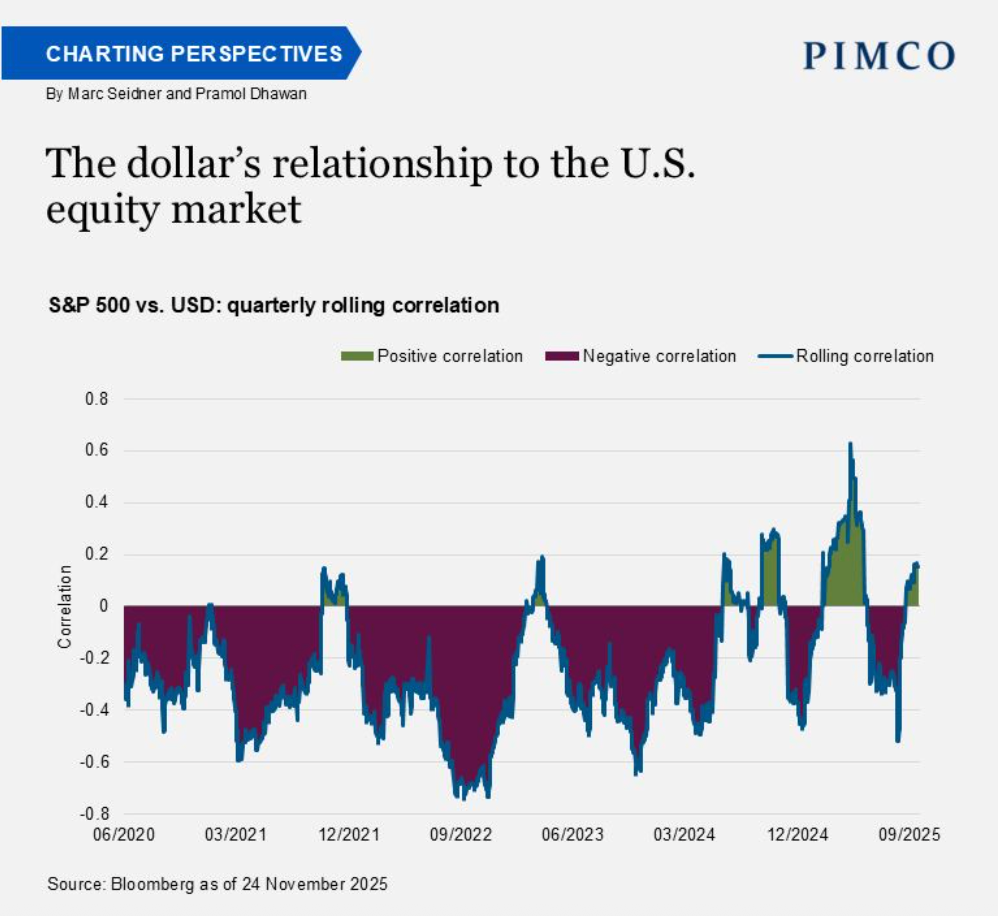

In their Charting Perspectives feature this week, Pimco has tracked the growing positive correlation between the US Dollar and US equities volatility, "a potential sign of diminished safe-haven appeal without a corresponding gain in risk-on support," the firm said in a note.

Managing Director Pramol Dhawan put the hammer down just a little further, calling the trend in his personal commentary "imperial overstretch in financial form" and the result of a hegemonic paradox that markets are increasingly unable to square.

"The dollar can't be both the world's shock absorber and reflect U.S. fundamentals—yet markets demand both simultaneously. When confidence in American exceptionalism wavers, there's no Plan B in traditional portfolios," he added.

Why it matters: Pimco says they believe the pattern, for now, is more to do with confidence (or short-term oscillation therein) behind American growth and fiscal credibility. Data suggests that the correlation trend has more to do with positions being unwound, rather than something more durable. But it's worth tracking closely.

In the meantime they are feeling cautious enough to recommend diversification, in "non-dollar real assets – such as commodities, inflation-linked bonds, and emerging market local bonds – for potentially more reliable equity hedges in the current environment."

That signals a second meaningful story for 2026: not just the extent of dollar weakness, but the impact of dollar volatility as it rides equities' tides, as well.